If you’re like me, you were taught to think about money in a particular way. Estimate how much money you bring in per month, make a list of expense and estimate how much it will cost, and then start tracking your spending as the transactions hit your bank.

I did that for 10 years. Expense tracking was really informative and helped me learn my spending patterns, but it didn’t allow me to proactively take control of my money.

Then I found a software called You Need A Budget (YNAB) and learned the 4 Rules that changed the way I budgeted forever. Let’s learn about The Four Rules and why they work.

What are the 4 Rules?

YNAB calls them “The Four Rules for Successful Budgeting”, and here they are:

- Give Every Dollar A Job

- Embrace Your True Expenses

- Roll With The Punches

- Age Your Money

If you’re new to the idea of the 4 Rules, you’re probably like, what does that even mean? Let’s talk about each one and understand why they’re important.

Rule One: Give Every Dollar a Job

Imagine that you took all the money you have in your checking and savings account, withdrew it from the bank, and dumped it on a table. You’re now staring at a huge pile of money.

I like to think of each dollar as my minion, and I’m the boss. I have to tell each dollar the job I want to do.

“You guys over there, you sit over there and pay the rent on the first. Everyone over there, your job is to sit in the savings account just in case I lose my job. Dave, you’ll pay gas; Jerry, you buy food.”

Why Rule One Works

Rule One is the basic principle of zero-based budgeting. You give every dollar you own a job to do. While it might sound simple enough, it’s actually a very powerful rule. In a single step, you’re accomplishing two important things:

- You are only budgeting money you have. This forces you to think in real dollars (not credit, not future paychecks, not money that might come in later) and grounds you in the reality of your financial situation.

- You are making a plan for your money before you actually spend any money. This allows you to decide ahead of time what is truly important to you. You create a plan for your money, and all you have to do is follow the plan. The best part is that your plan allows for flexibility and change because no actual money is spent yet (this doesn’t work when all you’re doing is expense tracking).

Rule Two: Embrace Your True Expenses

Have you ever had an unexpected car repair, once-in-a-lifetime trip, or big medical bill come by and completely annihilate your budget? You think to yourself, “Oh but this isn’t going to happen every month. This is an outlier.” So you ignore it and start over next month.

My friends, you are lying to yourself.

Maybe you won’t need to repair your car again next month. But are you comfortable saying that you will never need to repair your car ever again? Because that’s what you’re saying when you fail to prepare for that expense, when it will truly happen again.

Rule Two is all about embracing your True Expenses.

A True Expense is a non-monthly expense that will really, truly happen over the course of your lifetime. Some examples of true expenses are: holiday gifts, vacations, car or home repairs, computer replacements, and many, many more.

In Rule Two, we ask you to estimate how much you want to spend in each category per year and break it down into a monthly savings amount. So if you normally spend $1200 every year during Christmas, with Rule Two, you would set aside $100/month starting in January to ensure you had enough money once Christmas rolls around. If you guess that your old car probably needs $600 of repair every year, then you set aside $50 per month just in case the car breaks.

Why Rule Two Works

Rule Two is all about accepting what it actually costs you to live your life. This is why Rule Two is so powerful:

- It gives you clarity on your real cost of living. Without including True Expenses in your budget, you might think you have more disposable income than you do, and that leads to tricky financial situations where you don’t have enough money to cover the important stuff.

- By taking those outlier expenses and turning them into monthly “bills”, you are now able to take these costs into account when you make day-to-day spending decisions.

Rule 3: Roll with the punches

Many people think that budgeting is supposed to be strict. All the recovering perfectionists out there had a perfect budget that they had to follow, and if the month didn’t go perfectly, you threw out the entire thing.

But life never works out the way we plan. Even if you followed Rule 2 and saved $500 for a car repair, turns out it will cost $600. What do you do then?

Welcome to Rule 3: Roll with the punches. This rule is all about letting your budget be as flexible as life is. You can change your budget as much as you want, and it is okay.

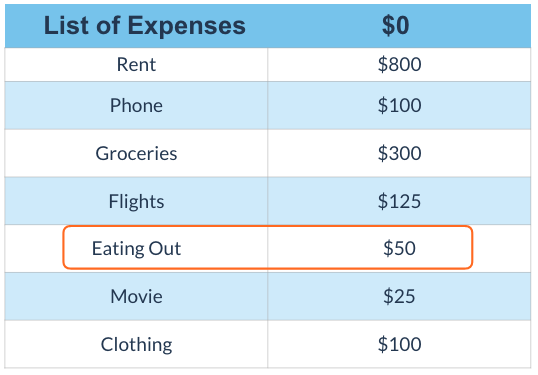

Imagine if you planned out your budget perfectly for the month. You set aside money for rent, groceries, gas, and even some money for eating out and clothing. But then a friend comes into town and you’d really like to treat them to dinner. You check your budget and see that you have $50 set aside for Eating Out.

$50 isn’t quite enough to go to your favorite restaurant, so you decide to take some of the money that you set aside to buy Clothing and use it for Eating Out instead.

Now you have enough to go to dinner. Changing your budget is a perfectly valid and okay thing to do!

Why Rule 3 Works

As a recovering perfectionist, Rule 3 is my personal favorite rule. For me, Rule 3 is so powerful because:

- Staying flexible with your budget makes budgeting a lot more forgiving and realistic. This makes it way more likely that you’ll stick to it and make informed decisions about your money.

- Rule 3 becomes powerful especially when you already followed Rules 1 and 2. Having extra funds set aside gives you more breathing room and funds to be flexible with.

Rule 4: Age Your Money

Have you ever wondered if you’ll make it to payday? I have. It sucks. And Rule 4 is all about breaking that paycheck-to-paycheck cycle.

“Age your money” probably makes no sense to you, and that’s normal. It’s just another way of saying, let’s get a month ahead in our budget. Let’s understand what aging your money means.

Imagine if the day you got paid, the dollars from your paycheck were newborn dollars. They are age 0. The next day, they would be age 1, and so on.

The question is, how old are your dollars before you spend?

If you get paid on Monday and immediately spend your entire paycheck on Tuesday, your dollars are 1 day old. This is an indication that you’re living really close to the edge, which I’m sure you know is really stressful.

Now, what if you got paid today, and you didn’t even need to touch that money for an entire month? This is possible because this month’s expenses were already covered with last month’s money. When you finally get around to spending this paycheck, the dollars are 30 days old.

The paycheck to paycheck cycle occurs when you have expenses piling up and you’re waiting to get paid so you can pay off the bills and debt that have accumulated over the past month. But what if instead, you had money just sitting around the account first? Now instead of waiting for the money, instead you’re just waiting for the bills to come in, confident in knowing that you’ll have enough to cover everything.

At this point, you’re thinking, “Sure that sounds great and all, but how do you actually get a month ahead?”

You do it by following the first 3 Rules:

- You give every dollar a job. When you do that, you prioritize and you’ll naturally find places to cut that aren’t as important to you.

- You save for non-monthly expenses by embracing your true expenses.

- And you’ll roll with the punches, keep your budget flexible so you can stay in the game.

One day, you’ll get paid, maybe near the end of the month, and you won’t need all of it for that month. So you decide to put that extra $5 or whatever it is into the future month. Maybe you’ll get a bonus, a tax refund, or any other kind of windfall, and you realize that this month is covered, so you put that into next month. As you continue to do this, your money gets older and older until one day, you’re one month ahead on your expenses.

At this point, you have broken the paycheck-to-paycheck cycle. You’re officially one month ahead and have the breathing room to make new financial decisions.

Why Rule 4 Works

Living paycheck-to-paycheck sucks. It limits your options and keeps you in a cycle of anxiety and stress. Rule 4 works because:

- It’s hard to save or invest when you can barely pay your bills. Rule 4 gives you a foundation of financial cushion that helps you build larger goals, like saving or investing.

- Rule 4 works when you follow the first 3 rules!

Conclusion

From personal experience, I believe these rules really work.

Old-school budgeting is shameful and unrealistic. Take YNAB’s Four Rules along with you as you explore how to create a budget that is way more fun and sustainable. By giving every dollar a purpose, embracing your non-monthly expenses, staying flexible, and working to get a month ahead, you will find clarity and peace with your money.

Need some help getting started with YNAB? Mindful Budgets provides one-on-one YNAB Coaching to make a budget that actually works for you. Learn more on our Services Page.